- The window for the prolonged “exclusivity” of US dollar support policy appears to be diminishing rapidly

- The US recorded a record merchandise trade deficit in March

- The performance of the Eurozone will improve sharply. The second quarter will significantly improve the overall picture

- UK GDP will return to pre-crisis levels in the third quarter of 2022.

- Sharp correction in Wall Street sells dollars (USD)

Dollar (USD) is an exchange rate under changing global sentiment

The report stresses that the window of prolonged “exclusivity” for US dollar support policies appears to be diminishing rapidly. Global sentiment should change as the Federal Reserve will not be very advanced in the global monetary cycle.

These articles will also interest you

– This undermines deeply ingrained but empirically flawed notions of eternal leadership in US interest rates, which were overlooked by the previous cycle. – He wrote the report.

The US recorded a record deficit in merchandise trade in March and UBS expects spending to translate into further deterioration, while weak services exports will also have a negative impact.

– An important side effect of the increase in domestic spending on commodities is the growing current account deficit. This reduces the impediments to the flow of US capital, which places a heavy burden on the dollar – added.

The euro and pound exchange rate supported by the recovery in the European Union and Great Britain

After very weak results in the first quarter, UBS also expects Eurozone results to improve sharply.

– Coupled with the gradual lifting of restrictions, the second quarter will deliver a noticeable improvement in the overall picture in Europe, which will help lift the EUR / USD rate. – shown.

Meanwhile, experts maintain a constructive attitude towards the UK economy with a stronger recovery.

– Overall, we expect UK GDP to return to pre-crisis levels in the third quarter of 2022, six months earlier than previously expected. – I noticed.

Strategists are noting that the Bank of England (BoE) has become more hawkish and expect the central bank to tighten its policy against the US Federal Reserve.

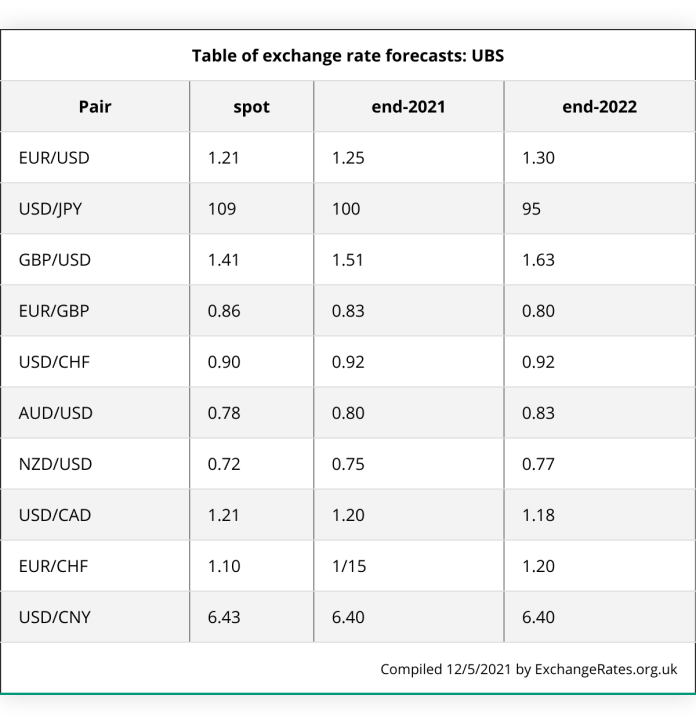

UBS improved its forecast for UK GDP and also raised its forecast for the GBP. The bank expects the EUR / GBP exchange rate to weaken to 0.83 by the end of 2021 and to suffer further losses to 0.80 by the end of 2022.

The investment bank also expects further losses in the dollar, and has a particularly strong outlook for the pound-to-dollar (GBP / USD) exchange rate. It expects the rate to be 1.51 at the end of 2021 and 1.63 at the end of 2022.

Also check:

Join the discussion by logging in with Facebook

Watch also:

“Music specialist. Pop culture trailblazer. Problem solver. Internet advocate.”