Good morning, and welcome to our renewed coverage of the global economy, financial markets, the eurozone, and business.

Britain spent another month of record borrowing as the cost of the Covid-19 pandemic continues to rise.

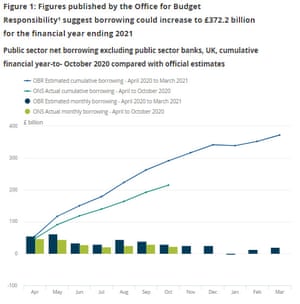

The most recent fiscal data, just released, shows that the UK borrowed 22.3 billion pounds in October to balance the books, about 10.8 billion pounds more than last year.

This was the highest borrowing figure on record in October. And the sixth highest borrowing rate in any month since monthly records began in 1993 (it was only overcome by April, May, June, August and September this year).

But it is much less than the £ 35.2 billion the city economists had forecast, and less than the £ 28.6 billion in September. [which has been revised down]. However, borrowing is heading towards record levels:

The Office for National Statistics reported that tax revenue fell last month, while the pandemic continued to drive government spending:

- Central government tax receipts are estimated to have reached 39.7 billion pounds in October 2020 (based on national accounts), 2.7 billion pounds less than in October 2019, with lower value-added tax (VAT), business and payment rates as well. (PAYE) earn income tax.

- It is estimated that central government bodies spent £ 71.3 billion on day-to-day activities (current spending) in October 2020, an increase of £ 6.4 billion from October 2019; This growth includes £ 1.3 billion in Coronavirus Job Retention System (CJRS) and £ 0.3 billion in Self Employment Income Support Scheme (SEISS) payments.

Since April, public sector net borrowing has reached £ 214.9bn – The highest public sector borrowing in any April-October period since records began in 1993.

Fraser Monroe

(Fraser_ONS_PSF)Borrowing in the first seven months of the fiscal year through October 2020 was 214.9 billion pounds, nearly four times the 56.1 billion pounds borrowed in the whole of 2019/20. #Deficit #debt # PSNBex https://t.co/Y5EmrtqZTo pic.twitter.com/N4LyBQbzJT

The news comes as the advisor has stated, Rishi Sonak, Ready to announce renewed pressure on public sector salaries in next week’s government spending review, as part of a Whitehall savings campaign to address record levels of government borrowing incurred during the crisis.

As our story explains:

It is understood that NHS Staff, including doctors and nurses, will be exempt from a renewed period of restraint to avoid sparking a public backlash as a result of the forward role healthcare workers have played during the pandemic.

However, unions have warned that renewing the wage freeze elsewhere would still be a fatal blow to employees thereafter. Boris Johnson He had promised to end austerity ahead of the 2019 elections, and with millions of key workers continuing to keep the country going through a health emergency.

BBC News (UK)

(@ BBC News)The Guardian newspaper Friday: “A new spending row with your age is putting pressure on public sector salaries.” #BBCPapers #TomorrowsPapersToday pic.twitter.com/Y3Hcgx5ID1

BBC News (UK)

(@ BBC News)Friday’s Mail: “Paying £ 5 million to fill the Covid black hole” #BBCPapers #TomorrowsPapersToday pic.twitter.com/PdcyqsYHxy

Meanwhile, European stock markets may be overshadowed by US policies. Overnight, US Treasury Secretary Stephen Mnuchin announced that some of the Fed’s emergency lending programs will end on December 31, when the CARES stimulus bill expires.

This may make it difficult for the central bank to shore up the US financial system, further complicating Joe Biden’s transition.

schedule of work

- 7 am GMT: UK public finances for October

- 7 AM GMT: UK retail sales for October

- 3 PM GMT: Eurozone Consumer Confidence report

“Music specialist. Pop culture trailblazer. Problem solver. Internet advocate.”