The Federal Reserve strengthened its monetary response to the epidemic, expecting not to increase interest rates until at least the end of 2023, indicating that it will not tighten policy until inflation is above 2 per cent “for some time”.

The new guidance from the FOMC implements a shift towards a more dovish stance in the long run Supported By the Fed last month, and it will likely translate into very low interest rates for years to come.

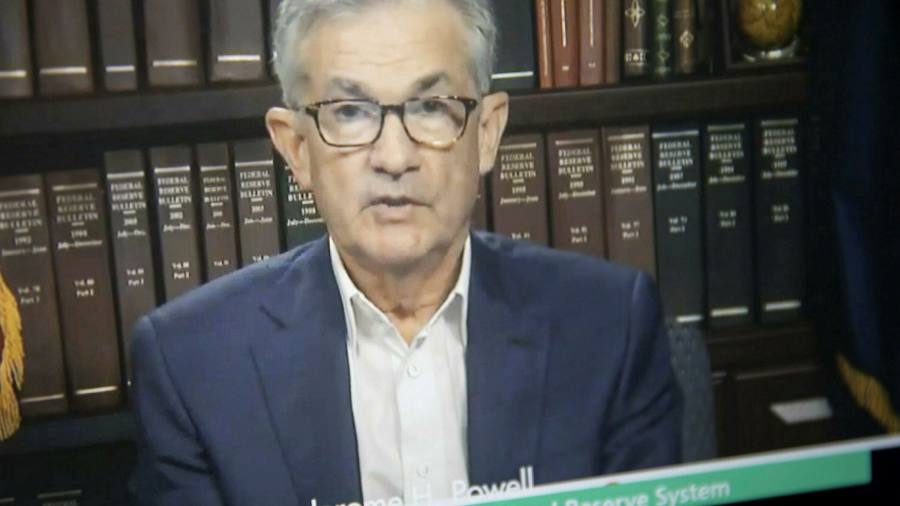

“This is all about credibility,” Powell said near the end of his press conference on Wednesday, “and we fully understand that we have to gain credibility.” “This framework, we have to support it with our actions, and I think today is a very good first step to do that. It’s a strong and powerful guidance.”

although The American economy It has recovered faster than the Fed had predicted at the start of the coronavirus crisis, the recovery remains far from complete and susceptible to the uncertain health outlook and waning support from fiscal policy. This has prompted Federal Reserve officials to discuss ways to bolster their support for the economy, rather than begin to withdraw it.

So far, the Fed has said it will not tighten policy by raising interest rates until it is confident that the economy has “weathered recent events” – assessing the economy on whether it has met its “maximum jobs” and “2” targets. Percent symmetric inflation. ”

On Wednesday, however, the FOMC set a more ambitious economic target. It said it “will aim to achieve moderate inflation above 2 percent for some time so that inflation averages 2 percent over time and longer-term inflation expectations remain steady at 2 percent.” He added that he expects to “maintain a favorable position of monetary policy until these results are achieved.”

According to the Fed’s median forecast, US output will contract by 3.7 per cent this year, compared to its June estimate of 6.5 per cent, with unemployment falling to 7.6 per cent by the end of the year, compared to the previous year. The unemployment estimate is 9.3 percent.

In a press conference following the announcements, Powell said the outlook assumed some additional fiscal stimulus from Congress. “It is likely that there will be a need for more financial support,” he said. There are still nearly 11 million people unemployed. A large portion of these people were employed in industries that were likely to struggle. ”

The changes to the FOMC statement reflect a new historical policy framework for the US central bank unveiled by Powell V. Jackson Hole Symposium Last month. He announced that the Fed would withstand higher levels of inflation in order to compensate for the long period of time in which consumer price increases have fallen below the central bank’s 2 per cent target.

Two voting members of the Federal Open Market Committee objected to the new statement. Robert Kaplan, chair of the Federal Reserve Board of Dallas, said he would have preferred the Fed to maintain “more flexibility in interest rates,” while Neil Kashkari, chair of the Minneapolis Fed, said he would have liked to have kept interest rates close to zero until inflation. . Reached 2% “on a sustainable basis” – arguably a more ambitious target.

On Wednesday, the Federal Reserve also said that it would “increase its holdings of Treasury bonds and mortgage-backed securities to the agency at least at the current pace to maintain the smooth functioning of the market and help bolster accommodative financial conditions, thereby supporting the flow of credit to households and businesses.”

Currently, US government securities are buying at the rate of $ 120 billion per month, with $ 80 billion in Treasuries and $ 40 billion in mortgage securities. Powell said the current price was “appropriate” given the economic and financial background, but acknowledged that the quantitative easing program could be adjusted if needed.

Long-term Treasuries were sold during Powell’s press conference, sending the yield on the 30-year Treasury higher by 0.02 percentage point to 1.45 percent. The 10-year benchmark yield rose 0.01 percentage point to 0.69 percent, while the more policy-sensitive two-year bonds were flat at 0.14 percent.

Meanwhile, equity markets turned bearish, as the S&P 500 erased its previous gains and closed 0.5 per cent lower.

“Music specialist. Pop culture trailblazer. Problem solver. Internet advocate.”