The deadline for settling income tax is April 30th. The bank, trusted profile or mObywat app makes the whole process simple and almost automatic. There is no penalty for forgetting settlers PIT-37 and PIT-38, but it’s still worth looking into your testimonials.

In early April, the government announced that “in this year’s campaign to file income tax returns, taxpayers have submitted more than 9.4 million statements so far” – 91 percent. From them electronically. This is not surprising for two reasons. First, there is an ongoing pandemic, so office visits are best avoided.

Second – and most importantly – online settlement is easier than ever. You can also count on a quick refund.

Tax offices make sure that the tax return is quickly transferred to the taxpayer account. Thanks to the solutions we provided, taxpayers who file personal income tax electronically can receive a tax refund a few days after filing the tax return – says Magdalena Rzeczkowska, President of KAS.

I can confirm it works. I received a tax refund in less than a day.

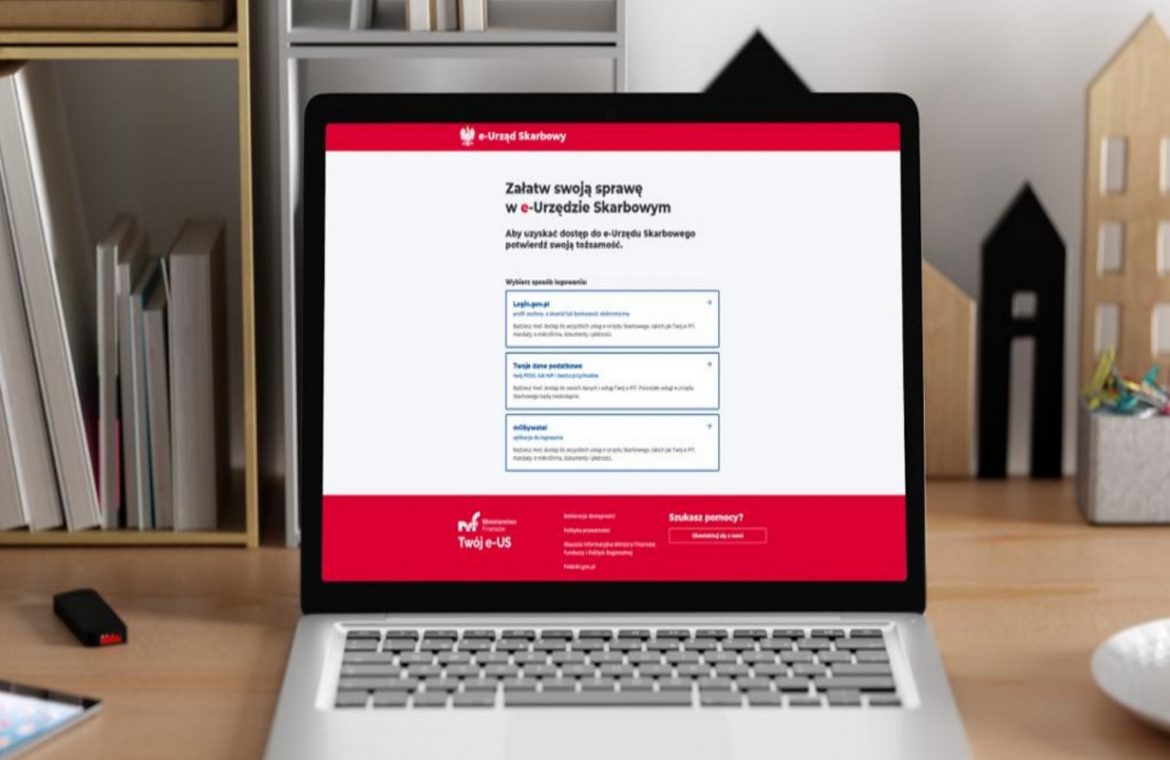

The income tax is settled through the tax office platform, where your e-PIT service is available. This is where we find the PIT-37 and PIT-38. The documents are ready there, so without looking at the site, the PIT will be sent and settled.

Why is it worth settling the hole? So the inscriptions are not lost.

However, anyone who checks the prepared data on their own can add the perks they are entitled to and donate 1%. tax.

The government website reminds you that we can log in:

- Through a trusted profile, electronic directory or electronic banking services (such as login.gov.pl)

- Tax data (PESEL or NIP and amount of revenue)

- MObywat application

The government particularly encourages the first and third options, and reminds you that “in mObywatelu you will not only find your electronic income tax, but thanks to the application, you will quickly and easily log into the electronic tax office, where you will find your annual tax return.”

“Extreme organizer. Problem solver. Passionate web buff. Internet expert. Devoted travel nerd. Professional troublemaker.”